Hello! I hope you’re having a fantastic day! Welcome to this very unusual blog post. Nice to have you with us today. For those that don’t know me, my name is Wayne Crowe. And I’m mega excited as usual.

I’m always excited to bring these types of things to you. This is different from what we normally do- really different from what we normally do. Normally everything we do is about traffic, converting traffic, creating shortcuts, and everything else. This is really different. So- here we go.

I’ve been involved in Bitcoin and cryptocurrencies for a long while. I’ve been doing it myself for…. hmmm… in fact I looked yesterday when I first bought my first Bitcoin and it was back in 2017.

So that’s what four years ago and I bought that when it was $3700. bought some just before that when it was 1800 GBP. I think that was rather than dollars, and obviously, it’s shot up a lot since it’s gone down a lot and – and if you don’t know anything about cryptocurrencies or Bitcoin or what they are, don’t worry. I have got someone I class as an expert on this.

There’s a lot of people out there that kind of post about Bitcoin, and cryptocurrencies when they become the fashion, then that goes away, and then they’re posting about something else again. Just to try and get some people into their new scheme, whatever that is.

This guy, he’s been doing cryptocurrencies for about four years solid and he’s been in cryptocurrencies for a number of years. I think about eight years now may pretty much just after it started, but I’ll let this guy tell you about it.

I actually you’ve known this guy for six or seven years, myself, okay, he was a solo ad vendor and he moved over to this. He was looking for a way to get paid and found cryptocurrency and moved over completely to it. So someone, I trust, is someone I like a lot and you guys will like him too, and he will show what he knows about cryptocurrencies.

This is a bit different from what we normally do, but this is the first income stream multiplier in OLSP. It is called Icoin Pro. Many many people in our group and elsewhere online have been scammed. This is why we are putting this on guys a lot of people get contacted and they’re promised these weird and wonderful returns, okay being scammed by three platforms exactly this is what we want to stop happening. I’ve seen people join these programs. I want that to stop and you’re going to see why when Paul comes on how he can help, and how you can learn cryptocurrencies the right way.

Okay, so let me introduce you to Paul De Sousa. I’ve known Paul for seven years when we first kind of I first heard of you anyway and when it comes to cryptocurrencies. This is the go-to guy. Okay, what we are about to show you today is the first thing I did when it comes to cryptos. This is what got me into it, and I now have six figures of cryptocurrencies in my portfolio because of what I’ve learned. Okay, so paul tell the folks a bit about yourself and how you fell in love with cryptocurrencies.

Paul: All right cheers, mate, so yeah, my name’s Paul De Sousa. I currently live in Johannesburg in South Africa. Although I’ve lived in a couple of places around the world and one of those places, was the Philippines, and while I was living there, it’s when I came across crypto and started taking it quite seriously about six or seven years ago, and it was out of necessity.

I’ve told the story a number of times, but PayPal had shut my account down. I used to do traffic. I used to sell a lot of traffic and, if PayPal doesn’t understand your business model, they will freeze your account and that’s exactly what they did to me and they closed my account with a lot of money in it, and I was kind of stuck.

A friend of mine had been trying to tell me about Bitcoin and I really was not interested. I didn’t want to know what this Bitcoin thing was and until I needed it, and I went back to him and I said to him: listen, I’m a bit stuck here, but can I use this Bitcoin thing to send and receive money? He gave me a crash course on Bitcoin and cryptocurrencies and when he was done, what I saw was that it wasn’t just a means to make money. I saw something that was going to completely and utterly change the world, and it was at that point that I knew exactly what I wanted to do for the rest of my life.

I had gone around looking around online trying to find more information and a lot of the information was really disparate. It was all over the place. There wasn’t any type of place that could teach a person from a to z about Bitcoin or cryptocurrencies. So that at that point I decided I was going to do something about that.

Because the one thing that he’s missing from the space is education- so my partner and I started talking about, putting something together for education. That’s how we got started in our company Icoin Pro and that’s what we focus on. We focus on the two different facets of education in cryptocurrencies, the one side we teach people about the basics like what Bitcoin is, how it came to be, why it came to be, and on the flip side, we teach people various ways to make money from cryptocurrencies and one of the big ones is through trading.

We teach people a method of trading that, if followed to the t, works, it just works and we fine-tuned that over the last four years, we’ve been around for nearly four years now, and we fine-tune that to the point where anyone who follows the system to the t -they there’s no reason why they cannot become a successful day trader.

Oh, that’s awesome. I’m tired of seeing people get drawn into these Ponzi programs. Like, “Give me a Bitcoin and you’re going to get two Bitcoin back in seven days.” They’re clearly, scams they’re, clearly Ponzi’s, but because people that maybe don’t understand basic, you know business and these cryptos.

The whole idea of putting this out there for our readers and in our income stream multiplier in OLSP is to stop people from falling for scams. We want you to go and do cryptocurrencies the right way. Paul, you’ve been doing this full time for a long while now haven’t you?

Paul: Yeah, absolutely. So the one thing through my investigations I found that there were a lot of companies that they promised a certain return. Now, folks, I don’t care who you are, there’s absolutely no one on this planet that can guarantee you a certain amount of income through cryptocurrencies or otherwise. And some of it just doesn’t make sense.

Now, there’s a lot of companies where they say to you, give us your Bitcoin and we will trade for you straight away. That’s a huge red flag, and this is why- Why does a company need to collect other people’s money to trade for them? Because if you such a hotshot trader, you can borrow five grand from your mum and then turn that into a couple of million. Okay, there’s no reason why they need to take your Bitcoin and trade with it. There’s no reason whatsoever. So anyone that that says that I immediately the red flags go up.

The only exception to that is are funds or industries where they’re, basically hedging from one investment to another. Now those are hedge funds, and normally those are set up by financial services, service providers, or whatever the case is but some mickey mouse company says that they will guarantee you a 30 return on your Bitcoin straight away. It’s a Ponzi and I’ve seen a lot of these come and go, and we do cover that a lot. We do cover a lot of that in our courses like how to watch out for these types of scams.

What are the things that you need to be to be aware of? The one thing I’ll tell you right now today is that, if you are not in control of your money if you’re not in control of your trades, you are in for a world of hurt.

Most recently we heard of a company MTI. A lot of people were saying. Well, I don’t want to learn how to trade, but there’s this company and they were called MTI there’s this company that they will trade for me and I warned people against them.

I said: look, this does not sound like it’s a good idea, because of all the reasons I’ve mentioned. Then a week ago, I learned that the CEO of that company made off with 17,000 Bitcoins, that’s 680 million dollars of the investor’s money, and a lot of those people that had said well, I don’t want to like learn how to trade I’ll just give this company, my money, they’ve gone very silent because now a lot of them are hurting.

It’s hurt people because it was a multi-national kind of like all around the world. A couple of South Africans lost millions, millions, people that I know personally, it’s absolutely crazy, so yeah. I do watch out for those scams, folks. If it sounds too good to be true, it usually is it is.

Wayne: There’s a new USI Tech Ponzi scheme a lot of these do payout in the beginning guys because they’ll think well it’s working and then you share it. More people come in, they share it. More people come and then all of a sudden the money runs out. Well, the money runs off. That’s normally a Ponzi, okay, so that’s how they work so Paul, just to explain to the people that are new to cryptocurrencies and Bitcoin. Can you explain in simple terms what they are, because it’s quite hard for me to explain to someone.

Paul: No problem. In order to fully understand cryptocurrencies you need to understand that over the past few thousand years, money has changed.

It has changed different forms initially way way way back when Mesopotamian tribes six thousand years ago, used to trade with each other.

They used to use things like weapons, or shiny shells, or salt as forms of money, and then it went over to precious metals, bronze and then gold, and then gold was used for a very long time until it got to a point where people decided “hold on gold is too cumbersome to carry around.”

In the early days, the bankers said “well give us your gold, and what we will do is we will give you like an IOU” and that IOU could have been anything. It could have been like an animal skin with a king’s stamp on it or whatever the case is, and that was used instead of the gold because they knew that they could always go and fetch their gold so that eventually became from animal skins and so on to smaller pieces of paper. To the point where we got the currency that we keep in our wallets today.

Along the way, there were a lot of problems. People used to take the gold coins and chip a little bit off it and when they had like every time that they got a new gold coin, they would just take a knife and just cut a little bit of gold off there. Until they had enough to create a new gold coin, that was an early day form of counterfeiting, and – and so many other problems came around.

The fact that that the guys that were controlling the gold were giving out more IOUs and demanding interest than what they actually were holding onto the gold and they were supposed to be an equal amount of gold and an equal amount of paper money. Because the one is an IOU for the other and the next evolution is now where people have gone okay. This has worked well for a while, but it could be better.

We were all asking how do we combat all the problems that we face with today’s modern money? It just led us to the point where the next form of money would become a digital form of money, and that is how cryptocurrencies were born.

It was out of a necessity to solve a massive worldwide problem, which was the problems that we face today with our money. One of the biggest problems actually came in the early 70s, where they severed that tie between gold and money, allowing banks to create as much money as they wanted to.

Them doing that created more debt. Because they would then pass on that extra money to two people in the streets and so on and so on in the form of loans and those people would need to then pay back those loans. It got to the point where we are now living in a debt bubble that this debt bubble is so huge. It is trillions and trillions of dollars in debt that is owed, so we got x amount of real money, yet x amount of debt, which is way bigger than the real money, and that is the reality of the type of world that we live in today.

So cryptocurrencies, and especially specifically, Bitcoin, was designed to combat those problems with money. That was the one thing and then the evolution after that which, which soon followed was this whole idea of….hold on….can we do something else with it? So they’ve been managing to take cryptocurrencies and solve real-world problems and completely change how we see finance.

And we’re in this phase at the moment where things are moving really really quickly and changing. Just because people have now realized that a digital form of money that can be accounted for at any point cannot be counterfeited, cannot be stolen like this.

Cryptocurrencies are solid and, and, the fundamentals behind cryptocurrencies are mathematics and people can’t trust any other form of money or anything else other than something that is completely logical, and that is mathematics, which is the driving force behind cryptocurrencies. So I kind of hope that that answers what cryptocurrencies are and why they exist.

Wayne: It does. The thing that amazes me is the tech. It’s not so much the cryptocurrencies themselves, it’s the technology behind it and the way the technology works. I don’t go into that too much, but basically, it’s a peer-based system, so you have basically a ledger and all these ledgers have to agree. So it’s always true. It’s always true. It’s basically the way it works. They’ve taken that so started with Bitcoin. They looked at the technology before this peer-to-peer kind of technology and they created other cryptocurrencies. So can you tell us some of the other cryptocurrencies paul just some of the big ones?

I can but firstly, I want to explain what blockchain is because I’m sure you guys have heard that as a buzzword. Everybody knows what they’ve heard they’ve heard the word blockchain before. But what is it and I’ll explain it really quickly.

Every transaction that happens on, say the Bitcoin network- as Wayne said it-It goes into this worldwide ledger, which then is stored on various computers around the world, and those need to be verified at all times between each other. The way that that that is done is every 10 minutes a new block of information containing the newest transactions gets formed and then gets chained onto the next block and the two have to match. So the new one contains information pertaining to the previous one. The next one continues to do so, so it’s a chain of blocks of information, and that is where the word blockchain comes from.

Now you can take this blockchain technology and there’s so much that you can actually do with it. One of the next biggest cryptocurrencies to come out after Bitcoin was Ethereum. A lot of you might have heard about Ethereum. Ethereum was not the first cryptocurrency to come after Bitcoin- that was actually something called Namecoin- which I’m not going to talk about, and there were a couple of others like Peercoin. But there was a massive game-changer because what Ethereum did was they looked at the Bitcoin model and they said “this is awesome and you got all these computers around the world which are verifying the transactions. But can we do something more?”

And the answer was “yes”. They thought, well, on top of that layer, maybe we can build applications- and the beauty of that is because your application will be hosted in millions of different places all at the same time it is guaranteed that no matter what application that you build on this, its uptime will always be 100%. Because the way that blockchain works is half of the network can disappear, but it is still there. The network will still continue to thrive and run, and your application will still continue to work.

So now guys took that idea and they went “Okay. What can we do now? So now we can build applications and the next evolution was to do something called smart contracts. Now, can you imagine, writing pre-programmed bits of programs that execute on a certain command on this blockchain and automatically funnel money to wherever it needs to go and that can be used in things like payroll. Because payroll is a big issue.

A lot of people get their pay wrong, especially when it’s done manually. You’ve got some woman who’s, not just that. She’s got a hangover after the night before and she’s trying to work out your pay and she gets it wrong and then, when she needs to try and fix it, you can only get paid again in two weeks’ time because that’s how payroll works.

But with blockchain technology, it’s a smart contract. It calculates automatically how many hours you’ve worked. It deducts your tax and sends your payment to you directly to your phone, no mistakes, so that would be like the next evolution.

But there are so many more coming out. Like civic, or civics been around for a couple of years, that is where they take your identification, they encrypt it, they put it on the blockchain. They know how old you are and so on. Then you can use your phone almost like an ID. You see these vending machines that sell beer and you need to scan the barcode to prove how old you are, and it dispenses a beer. How awesome is that? THAT is the power of blockchain and some of the new stuff coming out and there’s just so much more, there’s so many it’s limitless. The ideas behind that can come out with the technology is limitless.

Hopefully, that explains it, guys. I truly hope you realize how much Paul knows… he’s been doing this game along time. This is the guy that I trust, the only person I trust for information to do with crypto. Like the news, smart contracts, the technologies, and stuff coming out that lead us into the that whenever I look at a traffic source, whenever I look at any business model, I always try and look forward and think “has this got longevity?” We talk about that. A lot so – and that brings us to the next question I’ve got – is what is the future? Will it ever disappear? Will it kind of fizzle out or will it continue to grow? I know the answer to this, but I want the guys to realize this opportunity.

Paul: Right. Before I answer that I’m going to just really quickly, Google, something because this is I’m going to Google the question. “How many times has Bitcoin died”, because this is awesome all right? 390 times since 2010 and those are people like Forbes and, a lot of news outlets and like all these huge companies or financial gurus or whatever the case he’s saying Bitcoin’s dead, Bitcoin’s dying Bitcoin’s going away, but it seems to keep coming back to life, and today it’s sitting at over thirty thousand dollars. Bitcoin and cryptocurrencies are not going away. Bitcoin and cryptocurrencies are the next evolution of money.

A lot of countries have already started building fiat currencies on blockchain networks. So, basically, today we’ve also got another type of cryptocurrency, which is called a stable coin, and stable coins are pegged to a particular fiat, a fiat currency like the dollar or whatever the case is.

One of those is something called US dollar tether – USDT, it’s exactly one to one to the dollar and a lot of countries have now started doing exactly the same wherein especially out in South America, a lot of those countries there with a currency that is not stable and hyperinflation. All that they’ve now done is now starting to move away from normal currencies, normal fiat currencies and they’re moving towards digital currencies.

Now, if the whole world is now moving towards this new way of dealing with money – you tell me: is it going away anytime soon or is it going to evolve into a bigger monster?

Wayne: Mate, it’s going to get much bigger! And the thing that you have to think of at the minute guys – and this is the way I think of it – is what’s going on in the world with Covid and everything…a lot of currency is going to devalue against each other.

Paul: And people look and ask- Where can I store this money where it stores its value? And a lot of people move to cryptocurrency, which pushes the price up. It’s a store of value. Some people move to gold. Some people they’re kind of the two things I trust to store value. Okay, that is exactly what they’ve called Bitcoin – “digital gold”, because in times of strife, people automatically well, they used to turn to gold, so they would automatically take whatever other assets they had or whatever the money, they had and put it straight away into gold because it had a habit of holding it’s its value.

Now Bitcoin has been targeted as digital gold because of the same reason because it holds its value. Yes, there is a lot of volatility and we have seen Bitcoin go from eight cents right in the beginning, all the way to forty-two thousand dollars and back down initially back in 2017, went to nearly twenty thousand dollars went down to three and a half thousand dollars, but it always comes back. It wasn’t that long before, just back over ten thousand dollars went to 14,000 came down, then shot up to 20,000 came down, went up to 42,000. Now it’s come down and it’s this cycle. Folks, it’s a huge cycle. It keeps on doing that.

Wayne: The important thing that we want to get across is that…. what I want to get across is that Cryptocurrencies are not a scam. You’ve got to think. How do I get into it safely without being scammed? If you’re not on the cryptocurrency kind of knowledge train yet, how do you get into it? Well, that is the whole point of this. Stay to the end and I’ll show you the best source for cryptocurrency education.

Now, let’s talk about the thing that I think most people want to hear, which is the different ways to make money from Bitcoin, the proper ways to make money from Bitcoin. Not the “give me one Bitcoin I’ll turn it into three for you next week” garbage…

Paul: This is going to be a little bit of an educational session. I don’t mind I love talking about crypto. I love teaching people about crypto. I’ve been doing that for the last, oh God knows how many years now so yeah… I’m going to get really excited. I do want to touch on what Wayne said there about cryptocurrencies not being a scam. There are scams that have been executed using cryptocurrencies. There are certain ones that have done what they call scam exits. This is why we always tell people. Do your homework. Do your homework!

Don’t get sucked into the hype. When someone tells you “it’s the next Bitcoin” instead of running towards it, you need to run away from it.

Because people will tell you that. Especially in today’s times where they know that not enough people have got enough information to make an informed decision. They’ll tell you it’s going to be bigger than Bitcoin. That is very difficult to believe.

It is very difficult to believe when you think about the amount of money that has been poured into Bitcoin now, like 750 billion dollars, is what the Bitcoin cap worldwide cap is.

In order for the next cryptocurrency to come along and overtake Bitcoin that means that they would need to exceed that 750 billion folks, it’s very difficult…

Now on to the ways of making money from cryptocurrency the biggest way so far has been with mining. But the thing is to mine Bitcoin is, it’s difficult. You’ve got to pay for electricity. You’ve got to have the hardware. In the early days, guys used to be able to mine Bitcoin, just using a normal CPU on a laptop or whatever.

The case is, and the rewards, in the beginning, were huge because every time that a block was uncovered and I’ll explain that in some other sessions, but it’s basically Bitcoin works off a mathematical algorithm and every time that method that algorithm gets solved. The computer that solves it gets rewarded 50 Bitcoins and in the beginning, that’s the way it was.

But then every four years that reward halves. So it’s now become harder and harder to mine Bitcoin because the difficulty increases and the reward drops. So in the beginning people mined Bitcoin for dirt cheap using normal CPUs – you could do it on the laptop. But today, in order to mine Bitcoin, you need really powerful machines. Asic machines, they’ve got one function and that’s just to mine Bitcoin. So, in order for you to become profitable as a miner, you would need to invest a lot of money into a big mining operation. Sure if you want to be a hobbyist miner, you can do that, but it would never be life-changing. That’s one way.

A lot of people in the cryptocurrency industry took a look at the consensus algorithm, basically, the algorithm behind, solving, and making sure that everything was running smoothly on the network. The initial one was called proof of work which used the mining and they said: how can we change this? How can we make this better?

And then came out called proof of stake. Now that was the kind of next evolution in the consensus algorithms, where they now said. Okay, mining takes up too much power, all right, it costs far too much. Is there an easier way, and the answer is yes.

So they then develop this new technique called staking using something called proof of stake, where all that you would need to do is hold some cryptocurrency in a wallet and have it connected to the internet. It doesn’t use up a lot of resources, not like mining. And the network automatically pays you simply for doing that. That is active staking.

There’s a whole new way. A kind of sideway of staking called passive staking. Now you can hold certain cryptocurrencies in a wallet that are not connected to the internet and simply because you are holding them you’ll get paid. Sometimes on some of these, you can earn 12 to 20 per annum.

It is better than any bank. So a lot of people have now realized that staking not only helps the network and helps verify all the transactions that are happening, but it also increases the likelihood that a lot of these cryptocurrencies are going to increase in value because they are not on the markets. They are sitting in people’s wallets. That is the second way.

The third way that you can make money from cryptocurrencies is through trading. Okay, let’s get into trading in a second.

Well hang on- the third way is Investing. Which is, you buy some cryptocurrency today in the hopes that it will rise in value, and then you sell it sometime in the future. That is the third way.

The fourth way is trading. Millions upon millions of dollars – are traded. It’s a huge amount of money that gets traded every single day and trading does not take a huge investment. A lot of people have started really small and then increased as they’ve gone along and increased the amount that they’ve invested simply by compounding and we’re going to touch on that in a second. So there are four ways that you can actually make money from cryptocurrencies. Wayne, have you got any questions at this point?

Wayne: No mate.

Paul: Okay. Let me touch on ICOs. An ICO is an initial coin offering. It’s very similar to an IPO. That’s when a company would list stock on the stock exchange and they have like a pre-sale so that people can buy before it actually gets listed and then often the day that it gets listed, It shoots through the roof they sell, they make a fortune.

But there are a lot of instances where the exact opposite has happened, and one of those or two that I know most notably, is Snapchat and Facebook. A lot of people thought that Facebook stock was going to fly through the roof the day that it was listed, And guess what? It went down. It went the opposite way that people were thinking, and I would advise people that- if you’re going to start dabbling in ICOs. It’s a gamble. Unless, of course, you take the time, read the white paper, and get to research, every single person involved in the project and look at who’s running it.

Look at those people individually, because a lot of their websites will say yes advisory board and we got this guy from this country and that guy from this place and whatever the case is.

Go and Google those people go and look for their LinkedIn Profiles go, and, and – and do your research to see like and the one thing that you can do is type the person’s name, space, scam, type of person’s name, space scam. You keep doing that in Google. If a person is being involved in some type of scam or whatever the case is you do not want to get involved with that that ICO whatsoever.

But ICOs can pay off IF you do your homework if you choose them really really carefully, and for good reason. Whatever you do, do not get emotionally involved, do not let emotions make any decisions for you. You need to allow logic to dictate when you are participating in things like ICOs.

I’ll give you a very good example of the path I took when investing in an ICO. One of those ICOs that I made a lot of money from was Tezos. Now there was a reason everyone fell in love with Ethereum…it was a game-changer in terms of what they could do, allowing people to write applications on top of their network layer and also the smart Contracts and all the rest. The one thing, however, is that it was badly built, and now Ethereum kind of has to undo what they started in order to move forward with Ethereum 2.0.

I don’t know if a lot of people know that, but there are two different versions of Ethereum. Ethereum two will eventually take over from where Ethereum is Ethereum two will be proof of stake. Currently, Ethereum is proof of work which is mining, so you can currently only mine Ethereum. But moving forward into the future- but not just yet. When Ethereum two launches, then you’ll be able to stake it.

Tezos was a company that went “Okay, we’re going to build a platform very similar to Ethereum, except we’re not going to build it badly we’re going to do things from the ground up and build it with all the features and its own programming language and its platform and everything and its ecosystem without the mistakes that Ethereum. That stuck in my mind. I thought, “Okay, let me dig a little bit further into it”

Now before I continue there…

Back in the early part of 2017, when Bitcoin was just seven hundred dollars. There was a gentleman by the name of Tim Draper who’s a large venture capitalist. He called ten thousand dollars in 2017 for and he went on, he went live on tv, saying, listen! This Bitcoin thing is going to go to ten thousand dollars this year. People thought he was absolutely nuts. Now Tim Draper was half wrong because Bitcoin actually went to twenty thousand that year. So that made me go “Okay, so this is a bit of an important guy.”

Then I read that Tezos was the only other cryptocurrency that he had ever mentioned at the time, or spoke about or wanted to be linked to other than Bitcoin. So that made me go. “Okay, so Tezos they tried to fix a problem. It was Ethereum’s massive issue. And one of the other issues that Ethereum faces today is the price of the fees to send and receive coins on the network is currently heavy.

So what else is good about Tezos?. I’ll have a look at who’s behind the project. I realized that Tim Draper had spoken highly of them, so I decided yes, okay, I would go forward, then I read their white paper and understood it. Then I understood their vision. They made it clear exactly what they were trying to do and I invested in that ICO. I bought coins at 40 cents then. Today. It’s three dollars odd. That is how it’s done. It’s not a wish you know. You’ve got to do the work folks. Otherwise, all you’re doing is gambling, and I don’t want you to gamble. I would rather you take the time and research where your money’s going.

Wayne: That’s massive mate. If anyone is thinking that that’s massive advice, so let’s try and explain how many people know what currency trading is? How many don’t because I’ve got a feeling. A lot of people won’t know what this is. So I think we should give a nice simple example, maybe using Bitcoin and Ethereum, of how you trade to come to two pairs. Okay. So when we talk about pairs right, we’re talking one asset versus another and that it could be the dollar versus….well, anything really, I mean right across the board, without looking at cryptocurrencies trading would be anything from trading like on forex you’d have the US dollar versus the Canadian dollar or the South African Rand versus, the Great British Pound. Those are pairs.

Paul: Okay, when we talk about pairs on the stock exchange, it could be the US dollar versus Tesla stock. In cryptocurrency circles, like Bitcoin versus Ethereum would be a trading pair. The US dollar versus Bitcoin would be a trading pair. Tezos versus Binance coin. That’s a trading pair. Now how trading works is it’s almost like bidding like on an auction, okay, where the idea is to bid on a cryptocurrency that you want to try and buy at a lower price and then, as soon as you get it. Try and sell it at a higher price because the markets move.

There’s all this volatility and the idea is to try and find a wave or a pattern where something is about to come down and you wait for it to come down and as soon as it comes down, you try and pinpoint an entry point where you wish to buy and then when it climbs against its counterpart, it’s pair, then you sell. Now the beauty of it is there are so many cryptocurrency pairs that you’ll never be at a loss for pairs to trade.

Looking at different pairs. So when people think of trading Bitcoin, maybe they think well you’re, just trading against the dollar. No folks, there are so many different currency pairs, on various exchanges that you can actually trade against. I wouldn’t even know where to start telling you, because you can trade Bitcoin against almost everything you can trade the US dollar against almost everything.

You can trade Finance coin against almost everything on the Binance exchange. You can trade Ethereum versus almost anything. So, if you can imagine that there are thousands and thousands and thousands of different currency pairs and the idea is exactly the same: buy low, sell high. Buy low, sell high.

Look, you could invest long term buying a coin and selling when it’s high, but the thing is, nothing ever goes in a straight line in crypto. It goes up and down so along the way there’s this journey, where we see it, go up and down and up and down, and every time that it goes up we sell. Every time it comes down, we buy.

You might make 10% in a straight line, but if you had to do this and buy every time at the debt you might make 60%. So trading is a really really good way to make money with crypto and we’re going to, we’re going to talk a little bit about more about that.

Wayne: There are all these different cryptocurrencies which kind of makes it a bit more hectic, but also, which Paul explained now you’ve got different trading platforms so that comes into it as well. See different trading platforms often have different prices for these coins as well.

Paul: The differences are like- there are arbitrage opportunities. That’s sort of another way to make money from crypto, but it’s very similar to trading where you might have an exchange that would be like the stock exchange. But in crypto terms, there are so many different exchanges.

At Icoin Pro, we just focus on the biggest ones. That’s the ones with the most volume. Volume is really really important. One of the things that we look at and we’ll teach you about that. Because you might get to where you want to sell. The price might get to where you want to sell. But if there’s no volume nobody’s buying, and then you’re going to lose your trade. There are so many different exchanges and they all got their own interfaces. So you got, for example, Bitrix. The interface is a little bit difficult to use and it’s a bit archaic. If you ask me, you’ve got Poloniex , which is probably a little bit more of an intuitive interface to use, and then you’ve got Binance who are continuously updating, they’re the biggest on the planet. These are a little bit easier to use and they also use a lot of them use graphs from a website called Tradingview.

Tradingview is a website that is used by traders, regardless of what they trade they could be trading forex, cryptocurrencies, stocks, commodities. Anything like that and a lot of exchanges do pull information and they do use the charts from trading view. Binance does and it won’t take you too long to figure out. We actually show you how to figure out how to actually work everything and how to set up your graphs.

So I know that you’ve seen… I’m sure everybody has seen these blue wavy lines and you’ve got the like the red and the green candles and whatever the case is. Folks I know that it might seem like it’s very difficult to figure out what these things are. You know what, when you break it down into small bite-sized pieces, it is so easy to understand. That’s what we do, we break it down into these small easy to swallow bites that explain what a green candle is, and what a red one means, and what volume is, and so on.

Coupled together with that, you can also overlay these things called technical indicators. Technical indicators are blue wavy lines that give us an idea – and this is where we start introducing people to the basics. The basics of what is known as technical analysis, which we use in conjunction with without trading.

We only touch on very, very basic stuff with our Icoin Pro training. If you want to become like a swing trader or a trend trader whatever the case is, that’s when you start diving deeper into technical analysis. But as day traders what we do is we introduce you to the real basics, the easy to use ones and the ones that we’ve discovered actually work, and we and we show you how to overlay them on top of your graphs and we’ll show you when to buy in when it looks like something and then when to sell when it does something else.

Basically, you look at the trade and pays and you look at your phone signals, and these guys give you signals and say right: this should do in your favor, buy it. And that’s kind of how it works. They give you these things. They give you signals that indicate whether you should buy it or not. They’re, not always accurate, but you’re looking for as high an accuracy as possible, most of the time.

Now, let’s talk about when you’re trading these pairs, what kind of percentages are you looking for to win like what kind of percentages do you see? People look for different percentages depending on the type of trading that they’re doing.

Trained traders look for the bigger home run trades and they don’t mind waiting weeks or days. But day traders try and close all the trades within the same day. You can actually take a cryptocurrency graph and you can look at it at different time intervals from one minute, three minutes, five minutes, 15 minutes, 30 minutes, one hour, four hours, 12 hours, one day, one week, one month.

We as day traders look at everything at one hour and we use the five minutes as well. So we look at everything through five-minute glasses, as well as one hour because the idea is as a day trader you want to try and close your trades within the same day. The trend traders would like they look at long more long-term things. They might look at only days and weeks or look at months and so on.

We then break it down into these small sections and we then teach you how to start off your first trade and what to look at.

Now Wayne mentioned signals yeah right? We don’t call them signals, but all those wavy lines and all those technical indicators and whatever the case is…. they all mean something Like when those blue wavy lines those are known as Bollinger bands. Now you see this thing, there’s like this huge opening over there right, so we call that a bubble all right, and this and there are certain things that we actually look for. Like especially when there’s a downtrend within a bubble, there’s a certain pattern that we look for to try and find a trade.

Normally we look for something like three dips, so it dipped once their price climbed up, dipped down there, the price climbed up, it dipped again for the third time and there would have been one 1.3% profit that you could make there.

Now the question earlier was do you know what type of profits can you get when doing day trading? Well, it’s not uncommon to get the big trades, seven, eight, nine, even ten percent! Some of the guys do some big ones. If, if it’s like a really long squeeze pattern and a big breakout, you could make seven percent. But our system is known as the micro profit system because what we teach people to do is to make consistent, micro profits and compound those.

So, about technical indicators, you can see here that these bands, these Bollinger bands, they’ve, come together and the distance between the top and the bottom is 0.71 percent. Whereas the distance between here and the bottom one over there is 1.03. So we can see that it’s starting to squeeze together and when those Bollinger bands start squeezing together, it kind of gives us an indication that there’s going to be a breakout. We don’t know if it’s down, we don’t know if it’s up.

Then we try and understand and determine whether it’s going to be going up or down. We start looking at some of the other indicators such as the RSI. When the RSI goes above a number of 70% we refer to that as being overbought. Meaning too many people have bought and we’re going to see a reversal in price.

So you can see here exactly in line where it went overbought then the price started coming down and it went down to a point where it was now oversold. We also have these red and green bands. This is the amount of volume. Remember earlier, I said that that volume was incredibly important.

Not to worry about all this- Icoin Pro has software that monitors all these different indicators and the software is driven by an AI that tries to determine beforehand, and I’m going to give you guys. Do you want me to give a presentation on this Wayne?

Wayne: If we move on to talk about percentages and then we can do this afterward because a lot of people might be thinking, “you know, I only make one to three percent?”

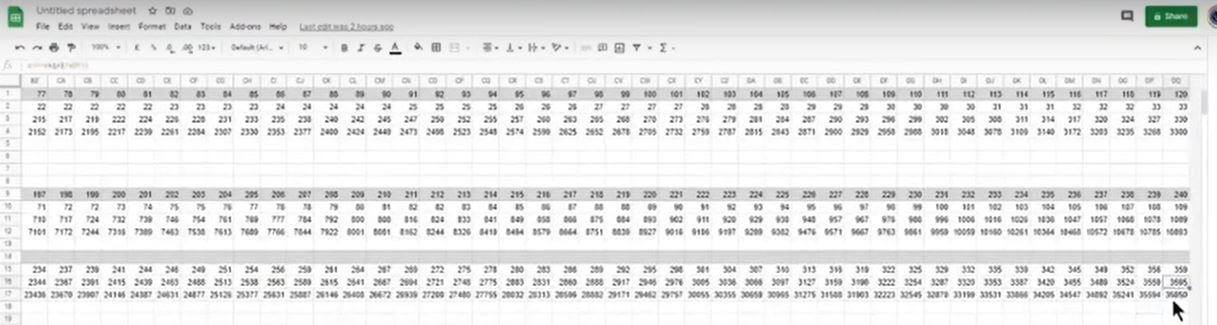

I want to explain one of the magical things- I want to talk about compound interest. Let’s say you make one percent per day, which is probably on the lower side if you’re good at this type of stuff. I don’t do day trading, but I guess that’s kind of what people should be aiming for. Let me share a pic of my screen and show you what one percent each day can do. Okay, now you can, you see my screen pic…

I’ve got started with ten dollars in this first column, the next day, okay, it basically says what if I grew that 1% per day, one day, two days three days, four so on, If you start with a hundred dollars -and you start trading with that- you can see what that would turn into.

I have one example of a thousand dollars okay and what that would turn into at 1% each day. If you made one percent per day, if you start with a thousand – and you add one percent the first day that turns into a thousand and ten dollars the next day, it actually turns into a thousand and twenty and ten cents.

Before long your thousand dollars become eleven hundred dollars and you’re, making one percent on that. Okay, so I’m actually making eleven dollars per day so hopefully, that explains it. So one percent per day, is what I’ve coached on. You can change this. I can give this out at the end if you want.

If you change this percentage to two or three percent that’ll all kind of happen and change the percentage. Okay, let’s assume one percent. Now, after, let’s look at the thousand dollars after almost a year, that a thousand dollars become thirty-six thousand dollars. Thirty, six thousand dollars from a thousand dollars by adding one percent per day.

What if we took the $36,000 or $35,950 and see what that would turn into in the second year? Okay, this is compound interest guys. This is what pensions are basically on. This is why it’s best to start a pension early because you get the compound interest, okay and that’s why they grow so much.

So taking the figure from year one and extrapolate to the end of year two, the compound interest turns all of those so that hundred dollars in year two is now worth thirteen thousand dollars. That thousand dollars is worth 129 thousand dollars in year two, and that ten thousand dollars is so big. It doesn’t fit in the graph, it’s now 1.29 million at the end of year two I think.

All that is because of the power of that one percent compounded interest over 2 years. Can you see the power of compound interest if you just earned that one percent per day? Albert Einstein is reputed to have said, “Compound interest is the eighth wonder of the world. He who understands it earns it. He who doesn’t pays it.”

And that is what all these big traders, all these big investment funds, that’s what they do. They understand compound interest. This is a massive thing. I remember the first time I understood the compound interest and I was amazed by the idea. So you can earn more than one percent. You can earn less than one percent you could have a minus.

But Paul has put together this software that kind of gives you them technical indicators.

Paul: It monitors the technical indicators and spits out probabilities. So when you take those coupled together with the training, because we teach you how to read the graphs, how to do everything and you couple those together. Then we actually feed you potential trades, that’s what it does. It gives you the potential trades and it’s up to you to actually then pull the trigger because we are not licensed to trade on behalf of other people, and I promise you if we said that we were after what I taught you in the beginning. You’d run in the opposite direction. Do not ever trust anybody to trade for you. So we teach you how to create that skill to make money on demand.

I know that sounds like a really eerie theory, but that’s reality. Folks, when you master this, you actually you’re actually mastering a skill that you can take anywhere in the world with you and make money on demand. So some of the people that trade with us or trade using our system make a full-time living, doing this- making money on demand.

Some of them go. Oh, okay! I need some petrol money. They do a few trades. They cash it out and off they go. And that is the reality.

Wayne: Tell us the story, which you told me. Yes, you want to know about yesterday. I think how she turned $100 into… tell us that story because this is the power of compound interest. You have to really get the power of compound and to see how powerful this stuff is

Paul: Well I’ll put a couple of stories together because it was a girl called Lee and a friend of hers called Lily and they joined Icoin Pro. When we first launched and between the two of them, they knew absolutely nothing about Bitcoin they’d heard about it, they wanted to learn a little bit more and Lee, approached her husband and she said, “Listen. I want to try this trading thing, and I want to put like $100 into it.

Now they used to do a pizza night once a week, and she said she said to her husband, “I’ll tell you what, if we can give up a couple of weeks of pizza nights, so I’ve got the hundred dollars. I want to give this trading thing a go.” She took that hundred dollars and in a space of about two years, she turned it into $115,000. The last time I spoke to her was back in probably the beginning of last year, the beginning of 2020 when she had surpassed $115 000 from then until now, she’s probably made another hundred thousand dollars.

Her biggest thing was that she always wanted to be a policewoman. She’ll probably kill me for for for telling, because, like her secret thing, she always wanted to be a policewoman and she didn’t ever want to worry about money. So now she’s in a position where she can actually chase that. Become a policewoman, do trading in her spare time, and still replace her previous income because she went full time.

Lee’s friend Lily was in a similar position where she hated her job. She hated her boss, and between the two of them, they mastered the system. Lily then went on to a point where she’s making upwards of two and a half to two thousand five hundred dollars a day from trading. All she wanted to do was replace her husband’s income so that she could have him at home more often. Her husband’s name is Mike Cannon and Mike then asked her “What is this thing that you’re doing?” and he jumped on board and now he’s been doing three thousand dollar days!

Lee is from, Australia and Lily and Mike they from New Zealand and they are probably some of our top mentors and they do training for us once every second week or so, where you can hop onto the training, and you can ask them questions about how to do this, how to do that, but it’s normally a set training. They say all right guys this is the first thing, this is the second, and so on. That is over and above the service that we offer, above the training that we offer they give up their time. They don’t get paid for it. They absolutely love what we do.

They’ve loved the new lifestyle and they’ve between the two of them, the two ladies Lee and Lily they’ve completely refurbished their houses bought new cars traveled. They like our poster kids for Icoin Pro because they are success stories and they’re very open. Now, there’s a lot of people similar to them. They don’t want to go on camera and tell people about their success, but Lee and Lily… we’ve asked them, “Would you mind mentoring?” and they’ve gone, “Sure no problem.”. I’ve met them in person. In Las Vegas, we do a convention in Vegas. They are the most genuine, down-to-earth people and they’re making thousands of dollars a day.

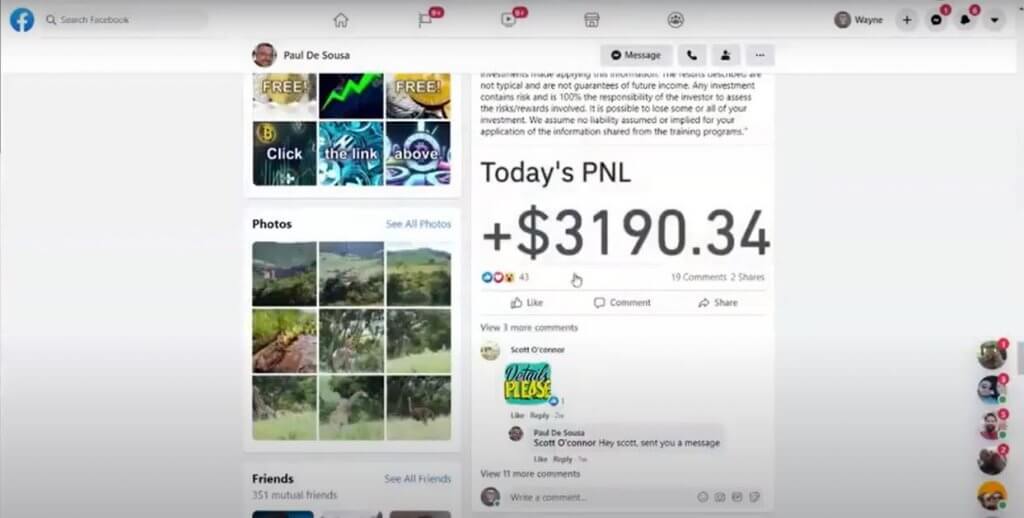

Wayne: What we’re going to do here Paul, what I’m going to show is Paul’s Facebook timeline. Just to show you Paul’s results again, he’s got some disclaimers on there and we’ll give a disclaimer as well. And then we’re going to show you an example. One example of the tools that these guys are put together. You can see it here. These are Paul’s results. today’s P and L.

You can see they got the disclaimer, okay, very important, it’s based on education. You can see Paul is a master at this stuff, he’s educated himself. He’s learned how to use the system. He’s learned how to use the tools, and there was a post actually done on the 18th about falling for these crypto scams. Paul, do you want to show us more of the software?

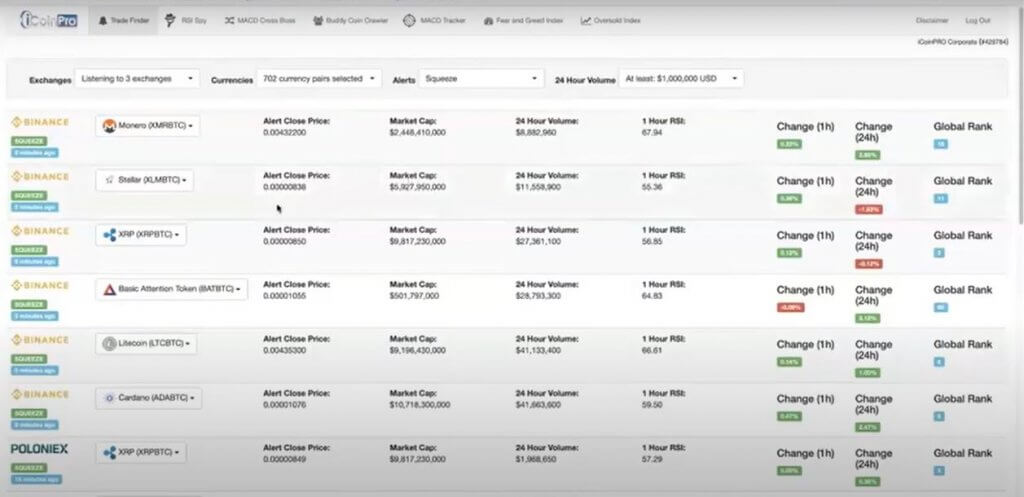

Paul: Sure Wayne, this is this is what we call the trade finder. Now the trade finder was something that we introduced to our training, probably about three years or about two and a half years ago.

Now – and this was a massive game-changer because, as I said earlier, this is a tool, that’s driven completely by an AI, and it automatically reads all those technical indicators, the Bollinger bands and the MacD and the RSI and so on.

It spits out what We call these probabilities now and I mentioned earlier on something called a squeeze. Okay. Now, that’s when the Bollinger bands are starting to come together, we look at squeezes. We look at anticipated dips. This is where the AI anticipates that a coin is about a drop in price, and then we also look at dips. This is why the coin is dipping currently dipping it lets us know. So maybe you want to try and catch the bottom of a wave. It lets us know, but we’re just going to be looking at squeezes. Okay, now remember. I said that there are so many different pairs all right. We look at certain pairs that only have a certain amount of volume, and we also look at different exchanges.

I’m just going to select I’m going to deselect some of the other exchanges. I’m just going to look at Binance. Binance is the biggest now. If you’re in the United States, you would use Binance.us, except if you’re in states like New York and Washington, then we would suggest that you use coinbase pro.

I’m going to show you this on Binance, and I’m going to select all the currency pairs that we have taught this AI to look for because we don’t want people to put their money into coins where the trades are just no good. Then you can also select to see how much volume in the last 24 hours recommended is $500,000. I’m just going to stick it on one million, and you can see that it’s now spitting out all these trades and then you’ve got some choices here and you can see that it tells us squeezes, there’s a squeeze.

If we had to select some of the others and add those in. We would then see them pop up. put the dips in there. It does this 24/7/ 365 non-stop. As long as these exchanges are running it does its thing. So while we wait for it to try and find some dips and anticipated dips, what I’m going to do is I’m going to show you what we would then do with this information.

Okay, so it’s telling us this coin over here Digibite is probably in a squeeze formation: okay and then you’ve got some choices. You can go to coinmarketcap, which is a website that will tell you more about the actual project. What is Digibite? What does it do, who’s behind it, and so on? Okay? Otherwise, you can go directly to the trading view and you can do some technical analysis there if you wish, or otherwise, you can go directly to the exchange that we’ve, that we’ve asked for.

So binance, I’m going to click on that button. Right now – and I want to go and see if the technical indicators are right – remember we said that we’re looking for a squeeze, so I just probably need to go in here and no, it’s not allowing me to okay, let’s just wait for it to load all right, okay, so the Bollinger, the Bollinger bands. Are there I’m going to go to the five minutes? Okay, that’s actually a horrible example. Let me find because this is a low, a bit of a low priced coin. I’m going to try and find something: that’s a little bit easier to see it. Okay, let’s, let’s do Monero so we’re looking for a squeeze formation where the Bollinger bands are slowly coming together. Let’s see how accurate the software actually is. It works best on coins that are aha.

Okay, can you guys see that the distance over there from there to the bottom is 1.76, but the distance from there to there is just 1.1 percent, so it’s definitely moving into what we call a squeeze position. A squeeze moving into a squeeze and possibly will produce what we call a squeeze trade. Then we teach you how to read all the other indicators to determine whether you actually want to get into this or not. So this is highly accurate.

I will: let’s go with another one I like. Okay, so like a light coin, so it says it’s going into a squeeze. We either look on the five minutes for one hour so right there, I’ve got it on five minutes. Okay. Aha! Look at that! Folks right so I’m going to measure the top there top to bottom 1.63 percent versus here 1.06 percent, so we can definitely see that it’s moving into a squeeze as well so folks. Yes, this software is very accurate Wayne back to you,

Wayne: Awesome mate so, but. What other, what other tools? ? Don’t let’s not go into depth in them, because we want you guys to see the part of these. What other tools have you got inside your software?

There I’m not going to share my screen, but we’ve got. We’ve got something called the RSI spine. What the RSI spine does is it remembers that one technical indicator that I spoke about where, if it was over x amount or over a certain amount, it was over overbought or if it was below it was oversold. We got a tool that displays all of those in terms of. Well, I actually asked I suppose I could show give me a second. Let me load it up. Go back to share my screen, it’s nice to see it with your own eyes.

I’ll show you, yes, okay, so you see everything that’s in red overbought, okay, so everything that shows up in red means it’s overbought, meaning that too many people have bought and the price is probably going to come down so that like we, would not want to Trade on any of those, we then move it around in order to try and find the green ones. we’re probably not going to see any green ones today, because the markets have been really really volatile today.

Normally it works on anything that is under no, so the only thing that it’s showing us today is anything that has been overbought all right and it works from under 30%. So if there was anything that was under 30% but sharp in green, similar to how this is in red, okay, anything that’s under 30%, it will show green anything. That’s over 70% will show red, and that will tell us whether the coin has been overbought or oversold.

So a lot of people use that as a strategy as well, and they just want to look for the things that show up on the one hour, the four hour of the one day, RSI as being green and then couple that together with the information that I’ve shown you before to try and determine whether this is a good trade or not.

Today, it’s all about what we call dips because prices have come down and a lot of stuff has been overbought. Hence, why we’re seeing all the red awesome? So it’s also another indicator to show you which way the market’s going. We’ve also got something called the fear and greed index. I’ll show you some of the stuff. When people are fearful, it will come inside and it changes. So you can kind of get an idea of what the sentiment across the entire market is about.

We’ve also got something called the oversold index which takes the entire market and has a look at what is oversold and when things are completely oversold like that, we start seeing a massive increase in the entire market.

Wayne: Awesome, so you’ve got everything with this tool. That shows you then it does all the technical analysis for you to go in and decide whether you want to take the trade based on their training, so guys everything we’re covered is kind of an overview, pretty in-depth. We covered a lot more than I thought we would.

Wouldn’t you love to get the tools and all the training behind it as well? Everything we’re covered here, how to use all the tools. This is all the training you need to make cryptocurrencies work in your favor, never worry about getting bloody scammed with cryptocurrencies again and get access to these all-important tools. The tools you’ve given us there that tool is amazing and the work you must put into that.

Paul: We continuously change and tweak and so on. So we’ve got a full-time developer. That continuously updates the AI to be a little bit more, responsive to try and find like we work out any kinks. I mean because this isn’t it’s an ever-evolving beast and we’ve always. We’Ve always got to try and update. Remove coins and so on, and so on, from the tools, so there’s always work going on in the background they are constantly updating and we do a commit at least once a week and from the repository to update it. So everything gets updated, weekly, so you’ll notice, so you’ll go in there and you’ll see that there might be 800 different pairs today. Tomorrow, 400 is because some have been removed, and so on and so on. So it’s always making updates awesome.

Wayne: So I’m going to show you how to get access to the Icoin Pro system and then Paul is going to tell you everything you get because this is fully comprehensive. So you go to your OLSP system. Go as soon as you log in you might need to log out and in again scroll down to income stream multiplier, okay, scroll down a bit. It’s all now open. Okay, it’s all now open click, income stream.

Click on tell me more: okay and then click start income stream. One now you just say that will take you here. Click get started, okay, scroll down and tick the $95.99 a month. Okay, now you get access to everything that has been mentioned. It’s absolutely massive guys. You get access to absolutely everything. The most important thing is the tools. You get access to the tools that were mentioned. You scroll down, put your billing info in you get straight in to let me log into mine and you go into the train and it shows you everything from buying Bitcoin using the software, absolutely everything.

So any problems with the link. Let me know, but the links are all in working now. You need to jump in guys because I do not want anyone ever joining something else to do with Bitcoin or any other cryptocurrency. This is the only training you’re actually going to need. With the tools that Paul and his team put together and spent four years developing.

Paul: Icoin Pro is to the point is where, where it is now, like I said you know, there’s still always ongoing work. We’ve got a full-time developer, who’s always updating stuff. Every Thursday we give out new training. It might be Justin does something called child talk where he discusses what’s happening on the charts. What to look for and so on. Lee might do some training. I might tell people how certain wallets work or so on and so on, so there’s always new stuff coming out.

Wayne: awesome, so guys, that’s exactly how you get it. There’s one more question: how does it work for taxes and things that will be a local thing? You need to that’ll be a local thing because it’ll be very different country to countries. There was actually a website called cryptotax(dot)io. So you can use that to use the API to plug into into into whatever exchange that you use like Binance or Poloniex or whatever the case is. Then what they will then do is determine based on your trades, what your profits were, and how much you owe in taxes.

Next question: will the fees eat up your profits? As long as you stick to going for above what the fees are so now on? Finance charges, 0.1 makers, 0.1 taker percent, so a total of 0.2? Okay, if you decide to use the native coin, the BnB Binance coin, to pay your fees, then you only pay 0.75 either way. Okay, so then your total, your total for trade, would be 0.15 percent, so that is a 15th of a percent. No, it’s no alliance it’s a tiny amount! So as long as for anything above 0.25 or half a percent one percent, two percent and you’re making more, then the fees are eating, you’ll always be in profits.

They actually have a calculator for that as well guys. We have in the back end of the website- we’ve got a number of different calculators for you for, for you to use, which includes the fees so like you put in what you bought that it will tell you this is what you should sell at, including that workshop the fees for you.

Wayne: Awesome, I’m going to show you once more how to get Icoin Pro guys, including the tools. We want these tools to take out all the confusion. Simply scroll down to the income stream multiplier. then click “start income stream” to get started. Top right you’ll see and click “get started”, then scroll down and tick the $99.95 per month- because you want access to the tools and there’s a little tick box there. If you want to become a super affiliate, they give you affiliate, training, and then affiliate details. Click join.

As soon as you’re in you’ve got all this stuff on the left and you can join their Facebook group and you can see their Facebook group. the group has eight thousand people, a fantastic Facebook group, guys, and then make your way through the training unless you buy here they give you a first making strategy. You get the calculators using all their tools, the calculator in here somewhere, but yeah. You get access to everything.

As soon as you join – and you can even go to genealogy and you’ll see I’ll actually start putting people in your team. Okay, but there’s more to it than just that, we’ll go through that in other videos.

Is there anything else you want to say Paul before we call it a day?

Paul: I just want to say thanks so much for joining us guys. It’s been a real pleasure. Add me, as a friend on Facebook, I’m happy to answer any questions. You know just anything that you throw my way, I’m happy to answer. If you’re a member of Icoin Pro I look forward to working with you guys look forward to answering your questions, look forward to getting to know you. Maybe at one of our Vegas conventions, you guys can come along. Tell us your story! How you took your $500 and $200 and turned it into $50,000. I want to hear that! Wayne thanks so much for having me. I appreciate it.

Wayne: It’s always nice when you share your knowledge mate. I will see you inside the Icoin group myself. This is fantastic and there’s something once you know it and once you know to use the tools, it never leaves you, okay, the tools aren’t going anywhere it’ll be here. Paul said, 25 years, I expect it will be okay, not like these other things.

Thank you very much, guys. thanks very much for joining us and we’ll see you on the next blog post and on the next live.

Take care!

Wayne Crowe